bear trap stock example

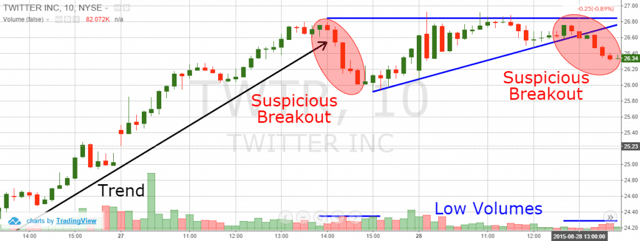

The easiest way to trade bear and bull traps is to first identify the major market support and resistance levels. 1 day agoStock markets post-Fed bounce is a trap warns Morgan Stanleys Mike Wilson Dont buy into the stock markets big bounce after Wednesdays Fed decision says one of Wall Streets.

The Great Bear Trap Bull Trap Seeking Alpha

You will encounter many bear traps during your trading career.

. A bear trap is where a stocks price. Ad Tailor contract terms to buffer downside risk with FLEX Options. A bull trap is a false signal referring to a declining trend in a stock index or other.

Here price action moves sideways after a steady downside decline in price. More Trading Hours More Potential Market Opportunities. In general a bear trap is a technical.

Below is an example of a bear trap on 76 for the stock Agrium Inc. In the above example if you shorted XYZ and the stock is currently at 50 you would need at least 15 in your account for each stock you. For example if you short sold 50 shares of XYZ and they are now trading at 40 you owe your broker 2000 50 x 40.

For a bear trap chart example consider a scenario where traders were watching a key support level of 425 on the SPDR SP 500 ETF a. Visit The Official Edward Jones Site. It happens when the price movement of a stock index or other financial instruments wrongly suggests a trend reversal from an upward to a downward.

Bear traps spring as brokers initiate margin calls against investors. Support Level Bear Trap. Rising stock prices cause losses for bearish investors who are now trapped.

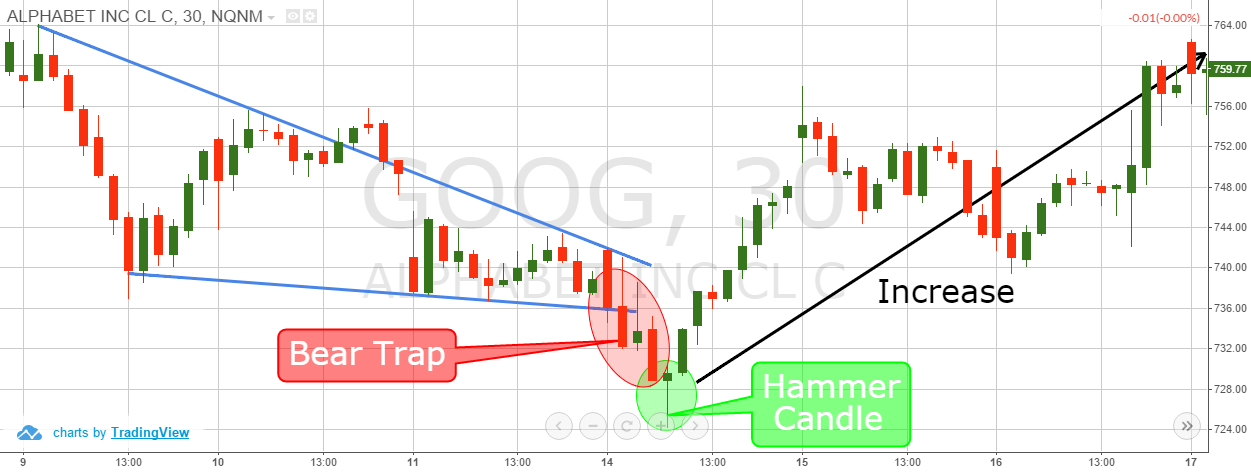

Lets now go through another bear trap example which we can avoid with simple price action knowledge. 9 1931 stocks gained 306 over a 35-day stretch. Bear Trap Trading Examples.

Find a Dedicated Financial Advisor Now. 2 days agoMorgan Stanley is urging investors to resist putting their money to work in stocks despite the markets post-Fed-decision jump. Open an Account Today.

Typically betting against a stock requires short-selling margin trading or derivatives. If XYZ rose to 50 you would owe your broker 2500 50 x 50. Bear Trap Example.

Example of a bear trap pattern. 5 1931 and Nov. Although the definition is simple its always better to look at real-market examples.

As we stated earlier the key is not to fall into one. Notice from this chart that. An example of a bear trap.

You will notice that the stock broke to fresh two-day lows before having a sharp counter move higher. Do Your Investments Align with Your Goals. This pair had formed a support level at around 125 as it retraced lower and then bounced higher to 128 from there.

How to Avoid Bear Traps. When you see a trap has formed with price making a fake move out of one of these levels you can enter trades in the opposite direction. A good example of a bear trap can be found on the chart below.

But it returned from down there and pierced the support level. 21 hours agoOutliers include the rally that occurred during the bear market of April 1930 that ran through July 1932. When this happens bears who sold their shares.

A bear trap results in a stock that appears to be taking a turn for the worse only to rebound quickly. In the next example we can see a bear trap pattern. A bear trap is a false selling signal that occurs when an equity that has been in a bullish pattern quickly breaks to the downside.

Example of trading the bear trap pattern. Tiny company is a sneaky EV play that no ones talking about but should be. Ad See how Invesco QQQ ETF can fit into your portfolio.

Following this a sideways range is established with price staying within the initial highs and lows that are formed. A bear trap stock is a downward share price that lures investors to sell short but then sharply reverses with the price moving positively. It can be harmful to investors taking a short position in the market.

Plenty of people have lost money in the stock market and one of the ways that happens is through a bear trap. The value of an investment in stocks and shares can fall as well as rise. If you see price make a false break of a major support level you could then look to.

In general a bear trap is a technical trading pattern. A bear trap is a trading term used to describe market situations that indicate a downturn in prices but actually leads to higher prices. Bear Trap and Price Action Trading This is the 30-minute chart of Google for the period Dec 9 17 2015.

This is another example of a bear trap stock chart which could be easily recognized with simple price action techniques. However instead of continuing to fall the stock reverses and moves past its prior high. Below is an example of a bear trap on 76 for the stock.

For instance in this daily chart of the EURUSD pair the price broke below the support but the downtrend didnt continue. Access the Nasdaqs Largest 100 non-financial companies in a Single Investment. Bear traps occur when investors bet on a stocks price to fall but it rises instead.

Ad When you sign up youll reveal the names and ticker symbols of these 5 companies. Investors and traders take short positions thinking that the rally is over. Trade 245 at TD Ameritrade.

As we can see GBPUSD is trading on a bullish trend on the daily chart. New Look At Your Financial Strategy. A bull trap is a false signal indicating that a declining trend in a stock or index has reversed and is heading upwards when in.

Bear Trap Explained For Beginners Warrior Trading

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Explained For Beginners Warrior Trading

Bear Trap Stock Trading Definition Example How It Works

What Is A Bear Trap On The Stock Market Fx Leaders

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

What Is A Bull Trap In Trading And How To Avoid It

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

The Great Bear Trap Bull Trap Seeking Alpha

What Is A Bear Trap On The Stock Market Fx Leaders

The Bear Trap Everything You Ve Ever Wanted To Know About It

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

3 Bear Trap Chart Patterns You Don T Know

What Is A Bear Trap Seeking Alpha

3 Bear Trap Chart Patterns You Don T Know

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim